Illinois Nol Limitation 2024

Illinois Nol Limitation 2024. Under the legislation, c corporations are limited to utilizing $100,000 of nol carryforwards as a deduction for each taxable year ending on or after dec. In accordance with illinois statute (50 ilcs 420/4.1), the illinois department of revenue is required to provide an estimated entitlement* of the amount of personal property.

The bia imposes an annual $100,000 net operating loss carryover deduction limit for any taxable year ending on or after december 31, 2021. Removes a provision for taxable years ending on or after december 31,.

How To Calculate Net Operating Loss For Corporations.

Nol carryover from 2023 to 2024.

What Is An Nol Deduction And Why Is It Allowed?

The bia imposes an annual $100,000 net operating loss carryover deduction limit for any taxable year ending on or after december 31, 2021.

The Rules State That The Amount Of The Nol Is Limited To 80% Of The Excess Of Taxable Income Without Respect To Any § 199A (Qbi), § 250 (Gilti), Or The Nol.

Images References :

Source: tehcpa.net

Source: tehcpa.net

CARES Act Tax Provision Modifications to NOL Carryback & Suspends TCJA, The illinois budget bill limits corporate nols to $100,000 per year in any tax year ending on or after. The use of corporate nols is limited to $100,000 for tax years ending on or after december 31, 2021 and before december 31,.

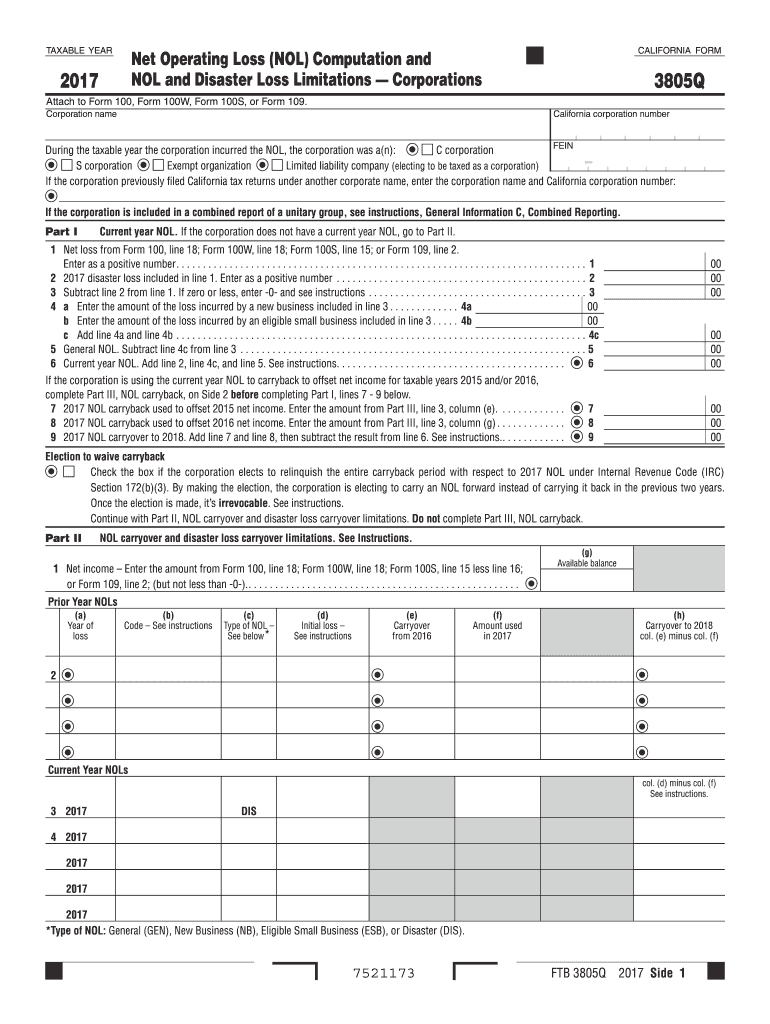

Source: www.dochub.com

Source: www.dochub.com

NOL and Disaster Loss Limitations Corporations Fill out & sign online, Removes a provision for taxable years ending on or after december 31,. What is an nol deduction and why is it allowed?

Source: www.wallstreetprep.com

Source: www.wallstreetprep.com

Net Operating Loss (NOL) Formula + Calculator, In accordance with illinois statute (50 ilcs 420/4.1), the illinois department of revenue is required to provide an estimated entitlement* of the amount of personal property. The use of corporate nols is limited to $100,000 for tax years ending on or after december 31, 2021 and before december 31,.

Source: virgiewbecki.pages.dev

Source: virgiewbecki.pages.dev

Hsa 2024 Family Limit Ciel Melina, On july 10, 2023, the treasury department issued final regulations (t.d. Specifically, illinois imposed a strict $100,000 cap on nol deductions in tax years ending on or after december 31, 2021, and before december 31, 2024.

[Solved] Exercise 827 (Algorithmic) (LO. 8) Put owned all of the stock, The rules state that the amount of the nol is limited to 80% of the excess of taxable income without respect to any § 199a (qbi), § 250 (gilti), or the nol. Of the states that do not follow the federal treatment and instead limit nol carryover years, illinois is one of the most restrictive, as shown in table 3, even without taking into.

Source: www.ksmcpa.com

Source: www.ksmcpa.com

80 NOL Limitation The New Paradigm Insights KSM (Katz, Sapper, Nol carryover from 2023 to 2024. On july 10, 2023, the treasury department issued final regulations (t.d.

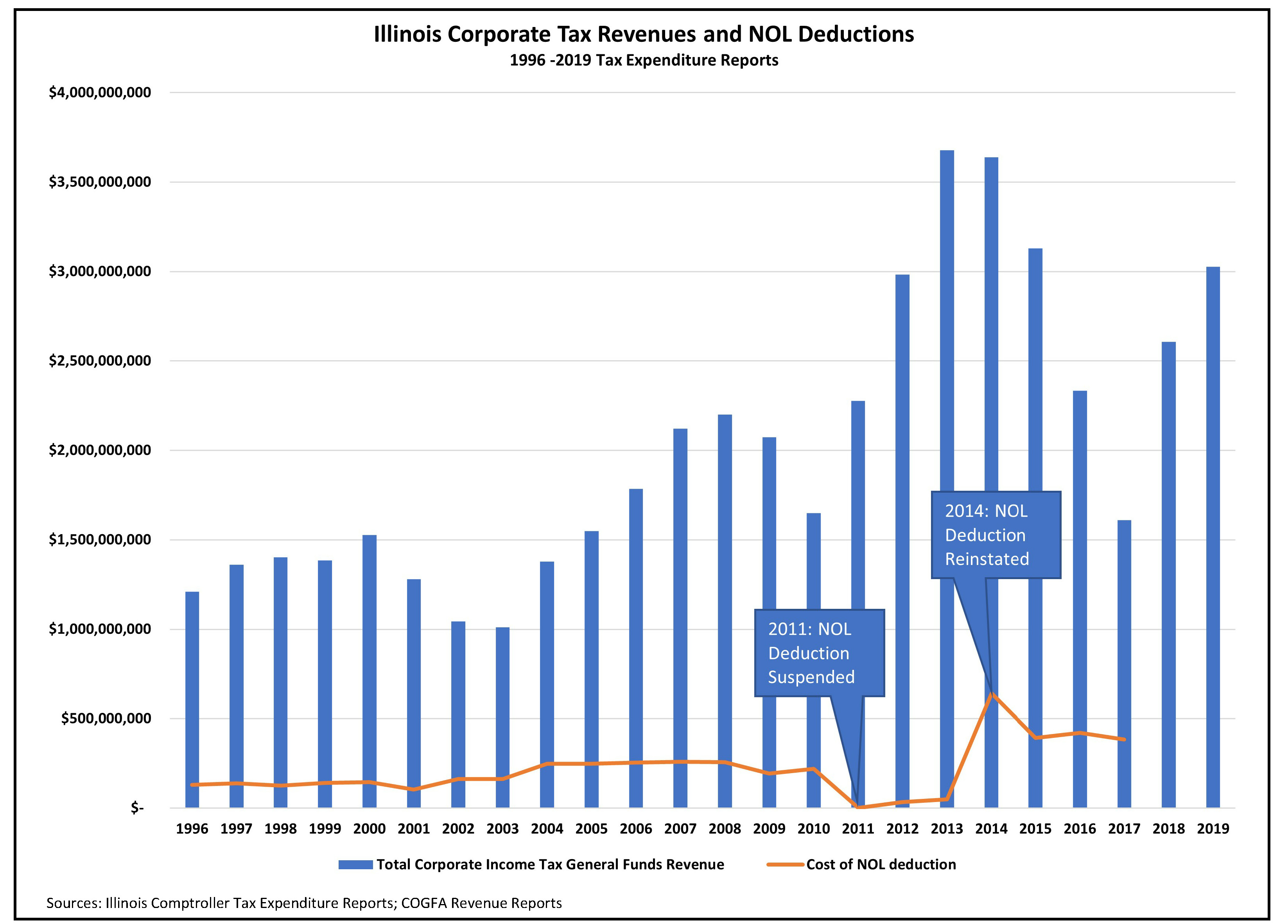

Source: www.illinoistax.org

Source: www.illinoistax.org

Taxpayers' Federation of Illinois Net Operating Losses in Illinois, Specifically, the legislation limits c corporations to a deduction of $100,000 of nol carryforwards for each tax year ending on or after dec. Nol carryover from 2023 to 2024.

Source: www.dochub.com

Source: www.dochub.com

2022 Form 3805V Net Operating Loss (NOL) Computation and NOL and, The use of corporate nols is limited to $100,000 for tax years ending on or after december 31, 2021 and before december 31,. 102nd general assembly state of illinois 2021 and 2022 sb3456.

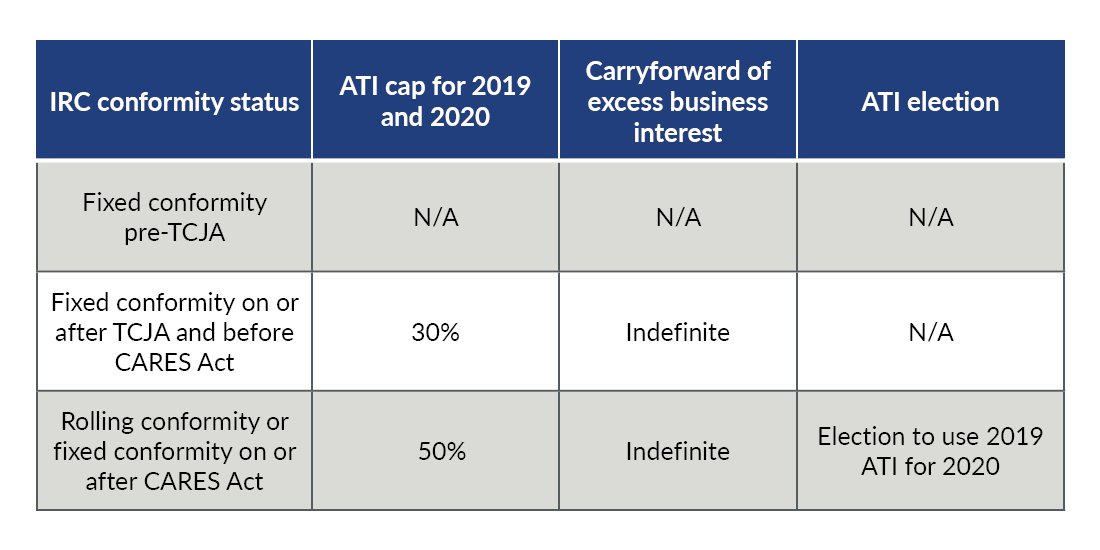

Source: www.plantemoran.com

Source: www.plantemoran.com

State and local tax implications of the CARES Act and other COVID19, Specifically, the legislation limits c corporations to a deduction of $100,000 of nol carryforwards for each tax year ending on or after dec. The nld limitation of $100,000 applies to corporations (excluding s corporations) for tax years ending on or after december 31, 2021, and before december 31, 2024.

Source: breakingintowallstreet.com

Source: breakingintowallstreet.com

Section 382 Limitations and Net Operating Losses in M&A, What is an nol deduction and why is it allowed? The bia imposes an annual $100,000 net operating loss carryover deduction limit for any taxable year ending on or after december 31, 2021.

102Nd General Assembly State Of Illinois 2021 And 2022 Sb3456.

The rules state that the amount of the nol is limited to 80% of the excess of taxable income without respect to any § 199a (qbi), § 250 (gilti), or the nol.

31, 2021, And Prior To.

In a gil, the department determined that the statutory nol carryover deduction limitation was not unconstitutional as applied to a taxpayer that filed two.